- Lowest price check

- Great Customers Review

- Fast and Accurate

- Lowest price check

- Great Customers Review

- Fast and Accurate

Check Vehicle Tax Status: Avoid Costly Penalties

Instantly check any UK vehicle’s road tax status before buying or renewing. Avoid fines, penalties, and legal troubles with our free car tax check tool.

What Does it Mean to Check Vehicle Tax?

Checking a vehicle tax is a quick way to find out if a vehicle is legally taxed and roadworthy in the UK. By entering the registration number, you can access real-time DVLA data including tax status, expiry date, and MOT details.

A car tax check is especially helpful for buyers or drivers who want to avoid fines and stay compliant with UK road laws.

Why Is It Important to Check Tax Status of a Vehicle?

Checking a vehicle’s tax status protects you from legal problems, fines, and nasty surprises when buying or owning any car in the UK. Here’s why it’s crucial:

Avoid Fines

Driving an untaxed vehicle can result in automatic penalties and enforcement action from the DVLA. You’ll get a fine in the mail even if you didn’t know the tax had expired already.

Stay Road-Legal

UK law requires all vehicles on public roads to be taxed. So checking ensures your vehicle is compliant. Police can stop you anytime and check if your car’s legal to drive on the UK roads today.

Make Informed Purchases

Used car buyers can confirm a vehicle’s tax and MOT status before buying, reducing the risk of hidden issues. Don’t get stuck with a car that needs expensive work or can’t be driven home from the seller’s house.

Confirm Vehicle Status

A car tax history check often includes MOT and SORN (Statutory Off Road Notification) information, giving you a full picture – you’ll see if the car’s registered as off-road or if it should have valid tax right now for driving.

Peace of Mind

It’s a simple, free way to avoid legal trouble and ensure the car meets all DVLA requirements. Knowing your car’s properly taxed means you can drive confidently without worrying about getting caught and fined by authorities.

Budget for Renewal Costs

Checking the tax status of a vehicle shows you when the next payment is due and how much it will cost. Different cars have different tax rates based on emissions, so you can plan your money better before committing to buy.

How to Check if a Car is Taxed

To check the current tax status of a vehicle, all you need to do is follow these simple steps:

Step 1: Enter the Registration Number

Enter the vehicle registration number in the search bar or search by running a VIN check.

Step 2: Click “Search” Button

Click on the “Search” button to initiate the search.

Step 3: See Tax Status & Get Full Car Tax Check Report

Our vehicle tax history check tool will provide information about the vehicle’s tax status, including the SORN status, tax expiry date, and more. You can also get the full car check report for a fee to check for outstanding finance, theft, MOT history, write-off status and more.

What Information Does Our Vehicle Tax Check Provide?

By using our car tax check tool, you’ll access the following information:

Current Tax Status

This will indicate whether the vehicle is currently taxed or not.

Tax Rate

This is determined by several factors, such as the vehicle’s CO2 release and fuel type.

Payment Due Date

This will show when the vehicle’s tax is due for renewal.

Outstanding Payments

This will indicate if there are any outstanding payments owed for the vehicle’s tax.

SORN Status

This will show if the vehicle has been declared as off the road and is not being used.

Vehicle Details

This will provide information about the vehicle, such as the make, model, and registration number.

Standard and Premium VED Rates for Six Months and Twelve Months

This will provide the applicable road tax rates for both six-month and twelve-month periods based on the vehicle’s emissions.

Get Full Car Tax Check Report

Aside from the tax status, details, and information, you can access more records with our registration number check tool. Here’s what you can find in the report:

Road Tax

Displays current tax status and expiry date, confirming the vehicle is legal to drive on UK roads today.

Outstanding Finance

Shows if money is still owed on the vehicle, protecting you from buying someone else’s debt problems.

Written-off Records

Reveals if the car was damaged in accidents and declared a total loss by insurance companies previously.

Stolen Records

Get a MIAFTR check to confirm the vehicle isn’t reported stolen, preventing you from buying criminal property unknowingly.

High-risk Records

Identifies vehicles with suspicious history or markers that suggest potential problems, fraud, or safety concerns you should avoid.

Vehicle Specifications

Lists exact technical details like model, year, transmission, engine size, fuel type, colour, and features to verify seller’s claims are accurate.

Scrapped Records

Shows if the vehicle was officially scrapped or destroyed, which means it shouldn’t be on the road anymore.

Auction History

Reveals if the car was sold at auction previously, often indicating fleet vehicles or insurance write-offs being resold.

Plate/Colour Change

Shows if registration plates or paint color changed, which might hide accident damage or cloning attempts by criminals.

Ownership Records

Displays how many previous keepers owned the vehicle, helping you judge how well it’s been maintained over time.

Imported Records

Confirms if the car came from abroad, affecting parts availability, specifications, and potential mileage discrepancies or clocking.

Exported Records

Shows if the vehicle was previously exported and reimported, which can indicate hidden problems or complicated registration history.

Log Book History

Tracks V5C logbook changes and keeper updates, revealing gaps that might suggest the car’s been sitting unused somewhere.

MOT History

Provides past test results, mileage readings, failures, and advisories showing how the car’s been maintained and used.

VIC Inspected Records

Shows if the car passed Vehicle Identity Check after being written off, confirming it’s been properly repaired and approved.

VIN Number Check

Verifies the unique vehicle identification number matches registration records, preventing you from buying cloned or stolen vehicles.

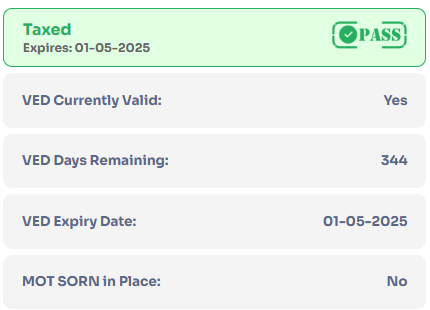

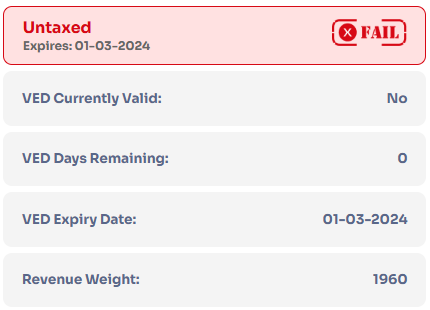

Taxed vs. Untaxed Vehicle: Check the Difference

Understanding the difference between taxed and untaxed vehicles helps you stay legal and avoid penalties when driving on UK roads. Here’s the difference:

Taxed Vehicle

- Legal to drive on UK roads

- No penalties or fines if up-to-date

- No impoundment risk

- No penalty points

- Not flagged by the DVLA

Untaxed Vehicle

- Illegal to drive without valid tax

- Risk of an £80 FPN, rising to £1,000

- Can be clamped, impounded, or destroyed

- Risk of penalty points on your licence

- May be flagged by the DVLA

When Should I Get a Car Tax Check in the UK?

Here are the key situations when you should check a vehicle’s tax status to protect yourself legally and financially:

Before Buying a Used Car

Always check tax status before paying for any used vehicle to confirm it's road-legal and won't need immediate expensive tax payments after purchase.

When Your Tax is Expiring

Check a few weeks before your tax runs out so you can renew on time and avoid driving illegally or getting automatic fines.

After Buying from a Dealer

Even reputable dealers can make mistakes with paperwork, so verify the tax transferred correctly and you're legally covered before driving away from them.

Before a Long Road Trip

Check your tax status days before travelling far from home to avoid getting stranded or fined in unfamiliar areas where fixing problems is harder.

When Buying at Auction

Auction vehicles often come untaxed and may have SORN declarations, so checking beforehand helps you budget for immediate tax costs after winning the bid.

If You Receive DVLA Letters

Getting warning letters from DVLA about untaxed vehicles means checking immediately to see if there's an error or if you genuinely forgot to renew.

What Happens If Caught Driving Without Road Tax?

Driving without a valid road tax is illegal and can result in penalties. If caught, you may receive an £80 Fixed Penalty Notice (FPN), which can increase to £1,000 if unpaid within 28 days.

Your vehicle can be clamped, impounded, or even destroyed, and you may receive penalty points on your license. To avoid legal issues and fines, ensure your vehicle is taxed, especially if buying a car.

If you’re unsure about your car’s tax status, you can use our car tax finder by reg tool by just entering the vehicle’s registration number. This will show if the vehicle is currently taxed, the due date, or declared off the road (SORN).

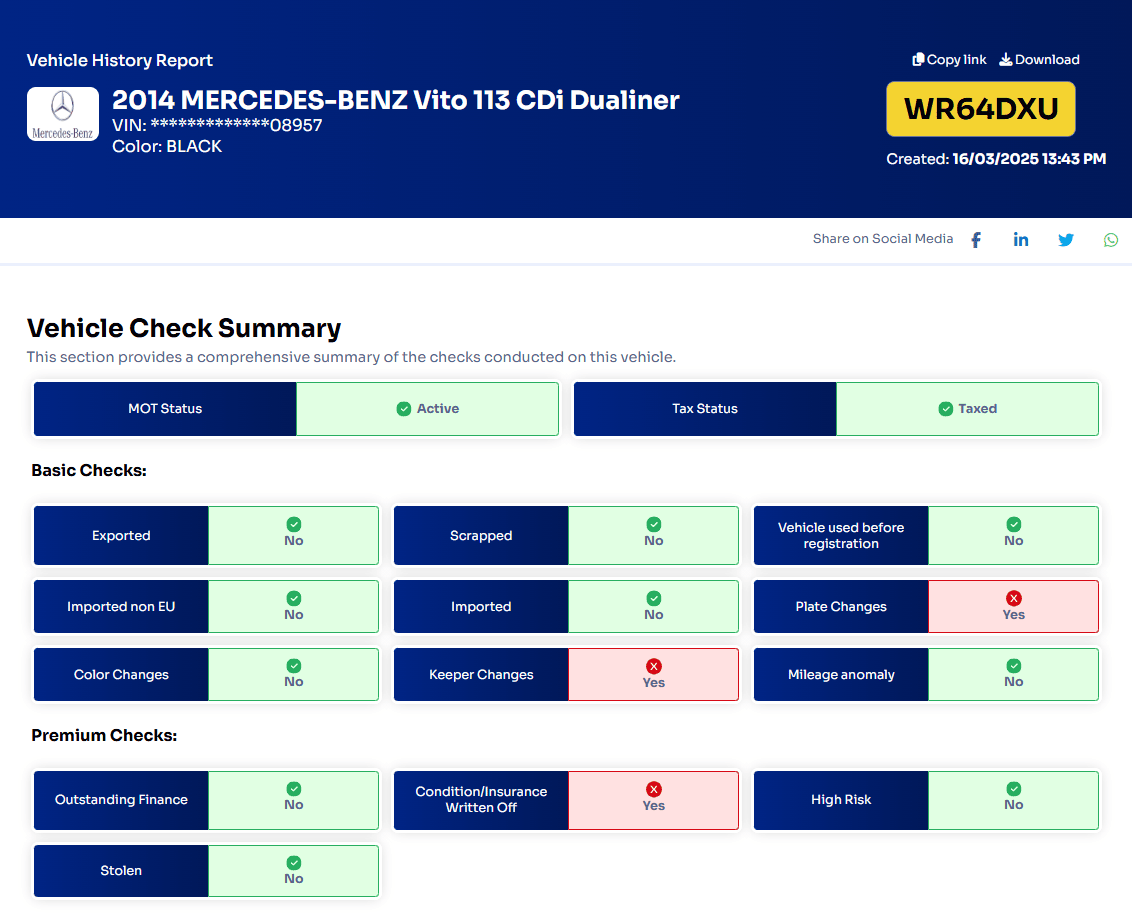

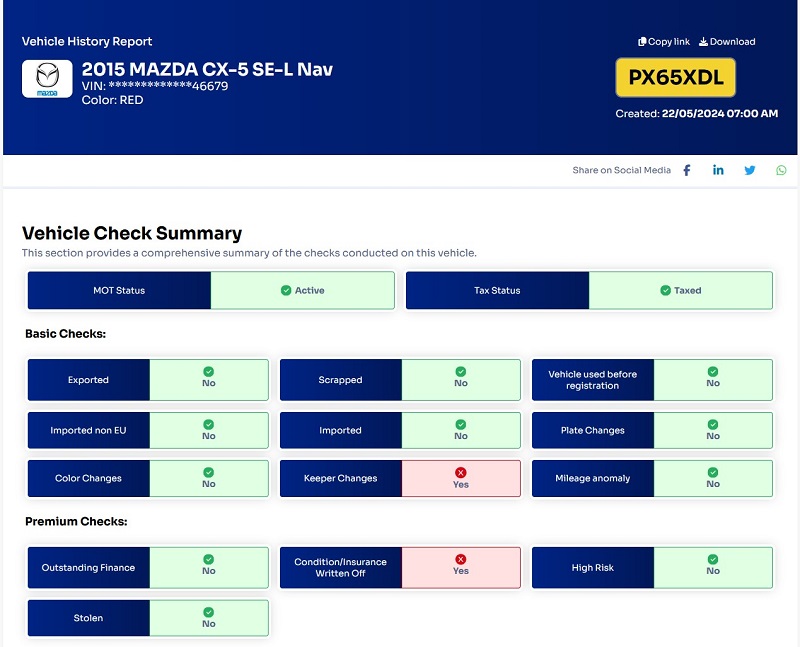

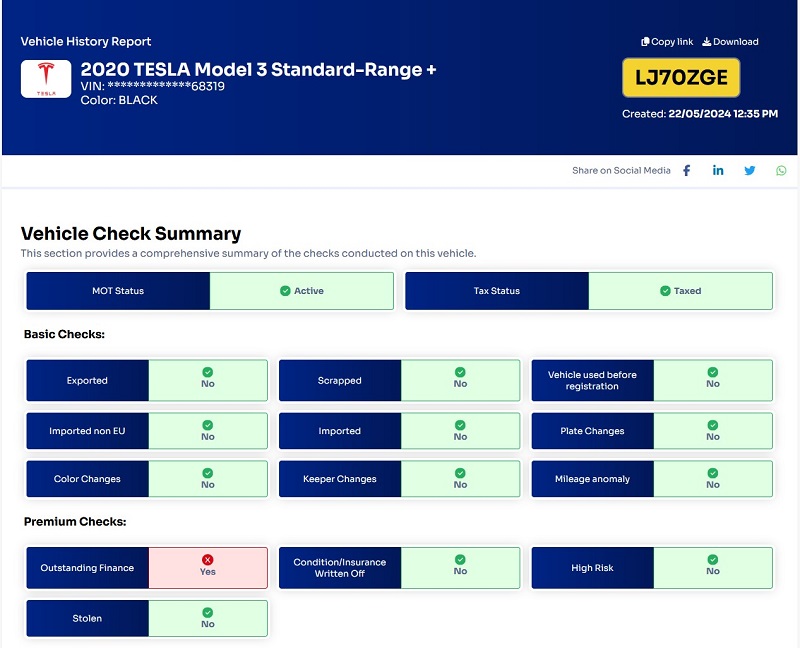

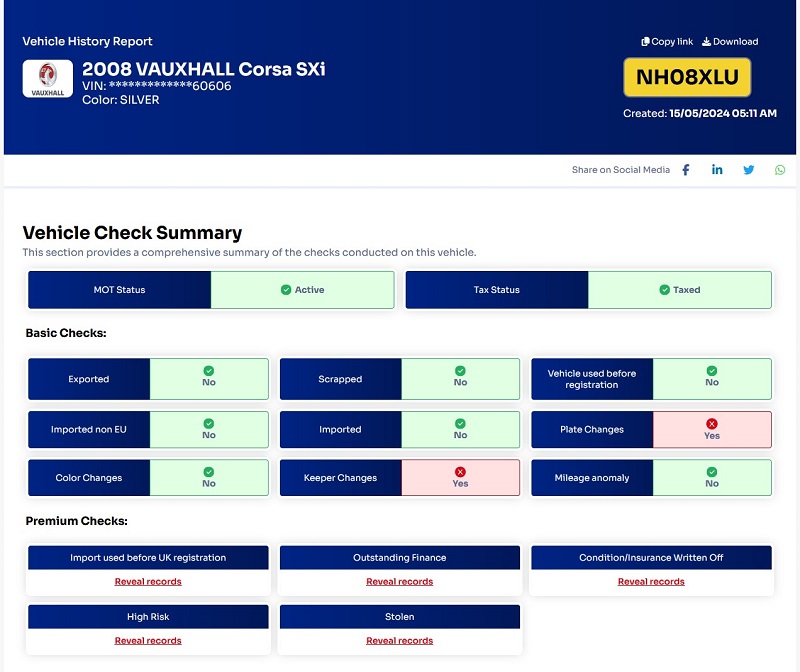

Check Smart Car Check Sample Reports

How Do I Tax My Car Online?

If your vehicle tax is expired or due, you will typically receive a reminder from the DVLA. When you get this reminder, it is important that you make the necessary payment as soon as possible to avoid being fined or going against the law.

You can use any of the following payment methods to renew your vehicle’s tax:

- Pay online through the DVLA website.

- Set up a direct debit for monthly or annual payments.

- Pay in person at a Post Office using cash, debit, or credit cards.

- Call the DVLA’s automated service for quick access to tax your vehicle.

One recommendation is to set reminders and renew your taxes at least two months before expiry. Also, check for exemptions to see if you qualify for any.

What UK Drivers Need to Know About the 2025 Car Tax Changes

The UK government introduced major road tax changes in 2025 that affect how much drivers pay for vehicle excise duty. Here’s what to know:

- Electric Vehicle Tax Starts April 2025: Electric cars now pay road tax for the first time. Previously exempt EVs must pay the standard rate like petrol and diesel vehicles.

- Expensive Car Supplement Extended: The luxury car surcharge for vehicles over £40,000 continues for another year. You’ll pay an extra £410 annually on top of standard tax.

- First Year Rates Increased Brand new cars face higher first-year tax rates based on emissions. The most polluting vehicles now pay significantly more than before April 2025.

- Hybrid Tax Benefits Reduced Plug-in hybrids lost some tax advantages they enjoyed previously. They’re now taxed closer to regular petrol cars rather than getting special low rates.

- Historic Vehicle Exemption Unchanged Cars over 40 years old still don’t pay road tax. If your classic was built before 1985, you’re still exempt from paying anything.

- Standard Rate Increased The flat annual rate for most cars went up with inflation. Expect to pay around £195 yearly for standard petrol and diesel vehicles now.

- SORN Rules Stay the Same Statutory Off Road Notification requirements haven’t changed. You still must declare SORN if your vehicle isn’t taxed and stays off public roads completely.

Can I Get a SORN Check?

Yes, you can get a SORN check with our easy-to-use tool. To determine if a vehicle is SORNed, you can check by entering your vehicle registration number into the car tax check form on this page.

A SORN vehicle is one that has been officially declared as off the road and not in use. This means the vehicle is exempt from road tax, and it cannot be driven on public roads. However, it can still be parked on private property.

Our Car Tax Check is Instant and Free – Why Wait?

Checking your car tax status is completely free and takes just a few seconds. Don’t risk driving without knowing whether your tax is up to date. It’s too easy to do; check it before it’s too late!

Explore Other Car History Checks

We offer additional vehicle checks beyond tax status to protect you from costly mistakes and hidden problems. They include:

Get the Smart Car Check Mobile App

Looking for the best car history check in the UK? Download the Smart Car Check App today. With just a registration number, you can instantly detect hidden history, past problems, or issues the seller won’t mention. Make smarter, safer decisions before buying any vehicle.

FAQ About Car Tax Check

What is a car tax check by reg?

A car tax check by reg is a simple process of finding out the tax status of a vehicle using the registration number and a vehicle check tool.

Why do I need to check my road tax online?

You need to check your road tax online to be sure your vehicle meets the requirements to be on the road and avoid fines or penalties. According to UK law, untaxed vehicles are not legally allowed to be on the road and they could even get impounded if left untaxed for a long period.

How can I check my car tax expiry date?

You can check your car’s road tax expiry date with our road tax check tool. Just enter the registration number into the form on this page to check your current car tax expiry date and more.

How can I check the cost of road tax by reg?

You can check the cost of road tax (Vehicle Excise Duty, or VED) by using our online car tax history check, which provides information on the tax costs for different types of vehicles based on their plate numbers.

Can I check my road tax status for free?

Yes, you can check your vehicle’s road tax status for free using our vehicle tax history check. You will also find the tax due date for free.

What is Statutory Off Road Notification (SORN)?

SORN stands for Statutory Off Road Notification. It is a declaration made to the DVLA (Driver and Vehicle Licensing Agency) when a vehicle is taken off the road and not used or kept on public highways.

How do I renew my road tax?

You can renew your road tax online, by phone, or at a post office. To renew online, you need to visit the DVLA’s website (gov.uk) and follow the instructions. You will need your vehicle’s registration number, MOT test number (if applicable), and a valid insurance policy.

Is road tax the same as car insurance?

No, road tax and car insurance are two separate things. Road tax is a tax that you pay to use your vehicle in the UK, while car insurance is a policy that protects you financially if you are involved in an accident or your car is stolen. Both are legal requirements for using a vehicle on public roads in the UK.

Do you pay road tax on electric cars?

Yes, from April 1, 2025, they will be subject to Vehicle Excise Duty (VED), with most paying £195 annually and those over £40,000 paying more.

How much is car tax in the UK?

The cost of car tax varies depending on factors like the vehicle’s CO2 emissions, fuel type, engine size, and when the car was first registered. To get an exact figure, use our online car tax checker to check the specific tax rate for your vehicle.

Can I tax a car without a V5C logbook?

No, you typically need the V5C logbook (also known as the vehicle registration certificate) to tax a car. If you don’t have it, you may need to apply for a replacement logbook before you can tax the vehicle.

Can I get a car tax refund if I'm selling my car?

Yes, if you sell your car before the tax expires, you can get a refund for the remaining tax period but you cannot transfer the tax obligation to the new owner. The automatic car tax refund will be sent to the registered keeper’s address.

What are the payment options for road tax?

You can pay your road tax online through the DVLA website, set up a direct debit for monthly or annual payments, or pay in person at a Post Office using cash, debit, or credit cards.

Can I check whether my car is taxed by VIN number?

Yes, you can run a VIN check to view the current tax status of your vehicle. On the form on this, Simply select “VIN check” to enter the VIN number You will immediately see the tax status of your vehicle.

How do I check if car tax is due?

To check your car tax due date, use our car tax check service by entering your registration number. The tool will instantly show if your vehicle is taxed, the expiry date, and the SORN status. You can also check the V11 form (DVLA reminder), your logbook (V5C), your DVLA account and direct debit email or letter.