- Lowest price check

- Great Customers Review

- Fast and Accurate

- Lowest price check

- Great Customers Review

- Fast and Accurate

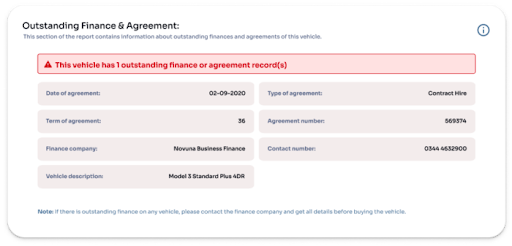

Outstanding Finance Check

Many used cars are bought on finance, meaning they could still belong to a lender. Avoid paying twice by running an outstanding finance check. Enter the registration number to confirm if the car is fully owned.

What is Outstanding Finance on a Vehicle?

Outstanding finance on a vehicle means the vehicle still has money owed to a finance company. When someone buys a vehicle through hire purchase (HP) or a loan, the lender keeps ownership until all payments are made. Even if the car looks fully paid for, it legally belongs to the finance company until the debt is cleared.

An outstanding finance check helps you find out if the vehicle has any unpaid finance before you buy. It protects you from repossession, dishonest sellers, and financial loss.

How to Check if a Car Has Outstanding Finance?

To check if a vehicle has outstanding finance, all you need to do is follow these simple steps:

Step 1 - Enter the Car Registration

Type or copy the vehicle registration number into the form above or search by VIN with our VIN check tool.

Step 2 - Search Vehicle Registration

Click “Search” to initiate the search and view free car check information like make, model, engine, fuel type, colour, tax details and more.

Step 3 - Get Car Finance Check Report

Our tool will instantly show whether or not a vehicle has outstanding finance records, the date, the finance company contact information, and other hidden records like write off, theft, etc.

A car outstanding finance check takes seconds, but could save you thousands. So you always check before you buy, and don’t get carried away by the seller’s recommendations or the ‘best price’ quote.

What is Included in Our Outstanding Finance Check?

Our vehicle finance check gives you full clarity on any financial agreements tied to the car, including:

Number of Outstanding Finance or Agreement Record(s)

Shows how many active finance deals are linked to the vehicle. More than one could be a red flag.

Date of Agreement

Tells you when the finance began, helping estimate how much is likely still owed.

Term of Agreement

Indicates the full duration of the agreement - useful for gauging how much time is left.

Type of Agreement

Reveals whether it’s PCP, HP, lease, etc., which affects whether the seller actually owns the car.

Agreement Number

Unique ID for the finance deal, useful if you need to contact the lender for verification.

Finance Company

Names the lender who holds legal ownership until the car is paid off.

Contact Number

Lets you reach the finance provider directly to confirm payment status.

Vehicle Description

Confirms the finance record matches the car you’re checking, like the make, model, etc.

A vehicle history check doesn’t provide just outstanding finance records. You can get everything you need to verify the actual condition of a vehicle before buying or selling. Here are other records to find in our full car check report:

Outstanding finance

Written-off records

Stolen records

High-risk records

Vehicle specifications

Scrapped records

Auction history

Plate/colour change

Ownership records

Imported records

Exported records

Log book history

MOT history

Road tax

VIC Inspected Records

VIN Number Check

Why Choose Smart Car Check Outstanding Finance Check?

It is always important to check for outstanding finance and vehicle history, especially before a vehicle sale or purchase. Here are some reasons why you should trust our tool:

Thousands of UK Car buyers Trust Us

Smart Car Check is used by thousands of UK drivers every month. Our reputation for accurate, reliable reports makes us a trusted name among both private buyers and used car dealers nationwide.

Instant, Real-Time Results

No waiting around; our system delivers full car finance check results within seconds. You get instant access to accurate data straight from UK finance and credit databases, helping you make quick and confident buying decisions.

Comprehensive Car Checks

We go beyond outstanding car finance checks. Every car check report includes detailed vehicle specifications, logbook history, ownership history, write-off status, theft mileage records, and more. We provide a total check for a confident peace of mind before buying.

Verified UK Data Sources

Our data is sourced from leading UK finance houses, credit agencies, and official records. That means every report is accurate, up-to-date, and backed by trusted national databases; no need to worry about outdated information.

Simple, Clear Reports Anyone Can Read

No confusing jargon or technical terms, just clear, easy-to-understand results. Even if you’re a first-time buyer, our reports explain everything in straightforward language.

Affordable Checks with Premium Accuracy

Smart Car Check offers premium-level accuracy at a fraction of the cost of other providers. You get a detailed, accurate car finance check report that protects your money without breaking your budget.

Why is a Vehicle Finance Check Important before buying?

Because what you don’t know can cost you your car — and your money.

Buying a used car without checking for outstanding finance is one of the biggest risks a buyer can take. If the vehicle is still under finance, you don’t legally own it, no matter how much you paid or how good the deal seemed.

Here’s why you must run a check before you buy:

Avoid repossession

If the seller hasn't cleared the finance, the lender can legally repossess the car, leaving you with no car and no refund.

Protect your investment

You could lose thousands if the car turns out to be financed. A quick check costs little, but could save you everything.

Don't get stuck with debt

If you unknowingly buy a car on finance, you may be held liable or lose the vehicle when the original owner defaults.

Spot red flags before it's too late

If there’s more than one finance agreement, or the seller can’t explain the details, it’s a major warning sign. A vehicle finance check helps you walk away before you're scammed.

Protects you from legal issues

Ensures you’re not unknowingly driving a car that still belongs to a finance company, which could lead to legal disputes.

Make smarter buying decisions

Knowing the car finance status helps you negotiate better or walk away from a bad deal entirely.

What Happens if I Bought a Car with Outstanding Finance?

“I bought a used car from a private seller, thinking everything was fine. Months later, I found out the car still had outstanding finance when a dealership refused my trade-in. The finance company said they still owned the car, and the seller wouldn’t help. I was left dealing with the finance company and at risk of losing both my car and my money.” A customer reported.

Here’s what can happen if you bought a car with outstanding finance:

The lender still owns the car

Even if you paid the seller, the finance company legally owns the vehicle. They can repossess it anytime until the debt is cleared, leaving you without the car or your money.

You could lose your purchase

If the finance remains unpaid, the lender has full right to take the car back. You might not get any refund from the seller, especially if they disappear after selling it.

Your legal options are limited

Because the car isn’t legally yours, taking action can be difficult. You’ll need to contact the finance company, prove good faith, and possibly seek legal advice to recover your losses.

You’ll face stress and delays

Dealing with finance disputes takes time and causes major headaches. Expect investigation, paperwork, and possible loss of transport while ownership is sorted, all avoidable with a quick car finance check beforehand.

Get an Outstanding Finance Check Now!

Don’t risk losing your money or your car! Before buying a car, run an outstanding finance check to show any unpaid debts instantly. One full check for a few pounds could save you thousands.

Outstanding Finance Check FAQ

Can you check how much finance is left on a car?

Yes. After running an outstanding finance check and finding out there is finance on the car, you can ask the seller or dealer about the status. If you’re the owner, contact the finance company for a settlement figure. A car finance check reveals details about the outstanding finance and agreement, like the date, term, name of the finance company, type of agreement, and contact number.

What happens if I buy a car with outstanding finance?

If you buy a car still under finance, the lender legally owns it. They can repossess the vehicle even if you paid the seller. You could lose both your money and the car unless the debt is cleared first.

Do I need to contact the finance company after buying a vehicle with outstanding debt?

Yes. If you discover outstanding finance after buying, contact the listed finance company immediately. Provide your purchase details and proof of payment. They’ll confirm the vehicle’s legal status and whether any outstanding debt must be settled before ownership transfers.

Can I keep a car if there is still outstanding finance on it?

No. It’s impossible to legally keep a car with unpaid finance. A car with active finance belongs to the lender until paid off. Even if you bought it in good faith, they can claim it back. Always check and confirm clearance before taking full ownership or using the vehicle.

How to sell a car with outstanding finance?

You must first contact your lender to get a settlement figure. Pay the remaining balance in full, then request a clearance letter. Only after the finance is settled and recorded as cleared can you legally sell the car.

How to buy a car with outstanding finance

Ask the seller to clear the debt before purchase or arrange payment directly to the lender using an agreed settlement letter. Always confirm with the finance company that the agreement is fully settled before transferring ownership or payment.

Can I part-exchange a car with outstanding finance?

You can part-exchange a car under finance, but the dealer will contact your lender, pay off the outstanding loan by using the value of your old car. If there’s any shortfall, you will need to pay it or get it potentially rolled into the new finance agreement.