Car Write-Off Check

Before buying a used car, run a car write off check. Verify the insurance write-off status and category (Cat A, B, N, or S), spot any high-risk records, and buy with confidence.

- Lowest price check

- Great Customers Review

- Fast and Accurate

- Lowest price check

- Great Customers Review

- Fast and Accurate

What is a Car Write-Off?

A car write-off is a car whose repair or loss is deemed unworthy by an insurance company. This may be due to an accident, fire, flood, or even theft, where the car was retrieved some time after. When such happens, the insurer compensates the owner for the market value of the vehicle rather than repairing it.

Not all written-off cars are scrapped. Some are repairable and can be returned to the road, but some are too unsafe to be driven again. By running a car write-off check, you will know the write-off status in MIAFTR, something you need to be aware of in case you are planning to purchase a used car.

Car Insurance Write-Off Categories Explained

Car insurance companies assign different write-off categories to vehicles depending on the level of damage sustained. These categories are:

Category A - Scrap, Not Repairable

Category A write-offs are vehicles that are damaged beyond repair with severe structural damage. They can’t be repaired, sold, or used on the road again. These vehicles are mostly scrapped, and a certificate of destruction (CoD)is issued after.

Category B - Break, Not Repairable

Cat B vehicles are severely damaged and cannot return to the road, just like Cat A. However, these vehicles can be stripped for parts and used for other vehicles. However, the chassis and body must be scrapped.

Category S - Structurally Damaged Repairable

Cat S write-offs, formerly Cat C, are vehicles that have suffered damage to structural areas of the vehicle but can be repaired to a roadworthy condition and driven again as long as they pass an inspection.

Category N - Non-structurally Damaged Repairable

Cat N write-offs, formerly Cat D, have suffered non-structural damage and can be repaired to a roadworthy condition. These vehicles do not need to pass an inspection before being roadworthy.

There is also Category F, which is not as common as the others, but it is used to classify vehicles that had minor fire damage that are repairable, but the insurers decided not to repair them.

Why Do You Need a Car Write-Off Check?

A car write-off check assists you in identifying whether a car has been involved in a major accident or has individual damage that has rendered it a total loss. With this information, car buyers and sellers can easily avoid these cars and not inherit hidden problems. The following are some of the reasons to get a write-off check:

Easily Spot Damaged Cars

In the absence of a car write off check, you might end up with a car that was declared a write-off but has some structural problems or other safety concerns, which would be costly to repair. A lot of these issues can not be seen in a brief examination, and that is why a car write-off check is the only sure method of getting to know about them.

Avoid Hidden Repair Costs

Through the write-off status of a vehicle, you can easily avoid a car with some damage that can cost you some unforeseen repair expenses in the future. This will assist you in budgeting in a prudent manner and will save you from unpleasant surprises after buying.

Ensure Safety

A written-off car in which the structure was damaged may be unsafe. Without proper repair, the vehicle might not meet safety standards, which could be life-threatening to you and your passengers. A full car check will prevent you from neglecting safety to take advantage of a cheap price.

Guard Yourself against Lawsuits

A car that is written off may not be sold legally unless it meets the repair standard and certification. In the case where the vehicle had been declared a total loss and not adequately rebuilt or checked, you would be breaking the law by purchasing, selling, and driving the vehicle. A car write-off check protects you against violation of the law.

Increased Negotiation Power

In case you get to know that the car that you want to buy has been written off, you get a chance to bargain the price down and not overpay for the car. With this information, you are at an advantage in negotiating a good deal.

Protect Your Money

A car write-off check helps protect your money by ensuring you invest in a vehicle with a clean history. Knowing whether a car was previously written off lets you make a smart, informed decision and avoid vehicles with lower resale value or with the potential of developing costly issues later.

What Kind of Information Does a Write-Off Check Show?

When you run a car write-off check, you would typically find the following information:

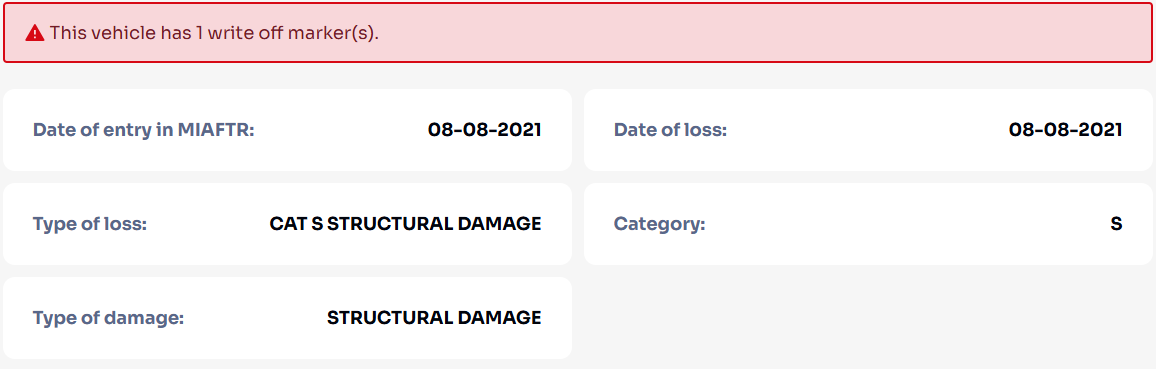

- Number of write-off markers: The number of write off markers placed on the vehicle.

- Date of entry in MIAFTR: Access write-off data from the Motor Insurance Anti-Fraud & Theft Register (MIAFTR).

- Date of loss: The date when the vehicle was deemed a total loss by the insurer.

- Type of loss and damage: The reason the vehicle was written off and the specific damage (e.g., structural, non-structural, etc).

- Write off Category: The classification of the write-off (A, B, S, or N).

A car write off check also provides access to other important records, which include:

Outstanding Finance

Shows if money is still owed on the vehicle. Without clearing finance, ownership doesn’t transfer legally, meaning you could lose both the car and the money.

Written-Off Records

Reveals if the car was declared a total loss by insurers. Essential for spotting serious damage history that could affect safety, reliability, and value.

Stolen Records

Checks police and insurer databases for theft records. Buying a stolen car risks immediate loss of both money and vehicle, plus potential legal consequences.

High-Risk Records

Flags vehicles linked with fraud, disputes, or suspicious activity. Protects buyers from scams and cars tied to ongoing investigations or financial risks.

Vehicle Specifications

Confirm make, model, engine, fuel type, and year. Ensures seller details match DVLA records, preventing fraud or the purchase of a cloned vehicle.

Scrapped Records

Shows if a car was declared scrapped. Prevents purchasing unsafe or illegal vehicles that should never have returned to the road.

Auction History

Reveals if the car was previously sold at auction. Useful for understanding its usage, like `fleet, rental, or quick resale, ' and assessing possible wear.

Plate/Colour Change

Indicates if the registration plate or paint colour was changed. Helps identify potential cloning, fraud, or attempts to disguise the vehicle’s true history.

Ownership Records

Details the number of previous keepers and the duration of ownership. Frequent changes may suggest issues, while long-term ownership often indicates better care.

Imported Records

Shows if the vehicle was brought into the UK from abroad. Important for checking history gaps, condition differences, and resale value.

Exported Records

Confirms if the car was registered as exported. Protects against buying a vehicle that should not legally be in circulation in the UK.

Log book History

Verifies the V5C document matches DVLA records. Protects against forged paperwork and ensures the car’s identity and registration are legitimate.

MOT History

Details past MOT results, mileage, and advisories. Helps assess maintenance, wear, and upcoming repair costs, giving a clearer picture of the car’s condition.

Road Tax

Checks if the vehicle is properly taxed. Ensures the car is road-legal and protects buyers from unexpected costs or penalties after purchase.

VIN Number Check

Confirms the Vehicle Identification Number matches official records. Essential for detecting cloning, fraud, or tampered identities in used cars.

How to Check if a Car Has Been Written Off?

Checking the previous owners of a vehicle is fast and easy with Smart Car Check. Simply follow these steps:

Step 1: Enter the Reg Number

Enter the vehicle registration number in the search bar or search by VIN.

Step 2: Search Reg Number

Click on the “Search” button to initiate the search.

Step 3: Get Write-Off Check Report

Our tool will provide you with a comprehensive overview of the vehicle’s insurance write-off status, including stolen records, outstanding finance, logbook history, and more.

What Happens if My Car is Written Off?

When your car is declared a write-off in the UK, it usually means the insurer believes repairs aren’t worth the cost. Here’s what you should expect if it happens.

- Insurance Assessment: The insurance company will send an engineer or assessor to inspect the vehicle. They decide whether it’s safe to repair or too badly damaged. Their judgment will also determine which write-off category your car falls into.

- Write-Off Categories: Cars are placed into categories like A, B, S, or N. Each category explains whether the vehicle must be scrapped or can legally be repaired. Understanding the category helps you know your options and future limitations.

- Settlement Payment: If the insurer declares the car a total loss, you’ll usually receive a payout equal to its current market value. This settlement allows you to replace the vehicle, though it may not match what you originally paid.

- Loss of Vehicle: In some cases, especially for Cat A or B write-offs, you will not be allowed to keep the car. The vehicle must be destroyed or stripped for parts, leaving you with only the payout.

- Vehicle Identity and VIC Checks: For cars in certain categories, you may need a Vehicle Identity Check (VIC) or equivalent inspection before returning it to the road. This ensures the car hasn’t been cloned or dangerously rebuilt.

- Impact on Future Insurance: Owning a car that was previously written off can affect its resale value and even future insurance costs. Some insurers view repaired write-offs as higher risk, so premiums or cover options might change significantly.

Get Write Off Check Report Now

Don’t risk hidden dangers. Our car write-off check instantly reveals accident history, categories, and safety risks, protecting your money, your safety, and your next used car purchase. Enter the vehicle reg or VIN to buy confidently.

Get our Smart Car Check Mobile App

Looking for the best car history check in the UK? Download the Smart Car Check App today. With just a registration number, you can instantly detect hidden history, past problems, or issues the seller won’t mention. Make smarter, safer decisions before buying any vehicle.

FAQs About Car Write Off Check

What is a write-off declaration?

A car “written off” declaration is when an insurer judges a car too expensive to repair or unsafe to return to the road. From there, it’s placed into a category that determines whether it can be repaired and legally driven again or must be scrapped.

Why did the write-off categories change?

In October 2017, car insurance write-off categories shifted from A, B, C, and D to A, B, S, and N to prioritize a vehicle’s structural safety rather than just repair costs. The old system was flawed because it didn’t accurately indicate a car’s safety concerns, especially in modern vehicles, with the new categories “S” for structural damage and “N” for non-structural damage. This provides clearer information to buyers and individuals about a vehicle’s structural integrity, which is critical for safety.

How does my insurer decide if a car is a write-off following an accident?

Insurers weigh the cost of repair against its pre-accident market value (ACV). If fixing it costs more than its value, or safety is compromised, it’s declared a write-off. The car is then assigned a category( A, B, S or N) reflecting its condition.

How much does a car write-off check cost in the UK?

The cost of a car check depends on the level of detail. Basic checks from Smart Car Check are only a few pounds, starting from £6.99, while a full check report can cost as low as £12.99. For the protection they provide, the cost is affordable compared with the risks of buying blindly.

What can I do if I don’t agree with the written-off decision?

You’re not stuck with the insurer’s first call. Ask for a second valuation, gather evidence about your car’s true worth, or even bring in an independent assessor like the Financial Ombudsman Service (FOS). Many drivers successfully negotiate better outcomes by challenging the insurer’s initial decision.

Should I Buy a Written-off Vehicle?

Before purchasing a written-off vehicle, ensure it is a Category N or S, has been professionally repaired, and you are fully confident in its safety and structural integrity. Check the car history and an independent inspection to verify its condition and repair quality, and to confirm it is a Category N or S write-off, not a Category A or B, which should not be repaired or driven again.

Can I sell a car that has been written off?

Yes, you can sell a repaired written-off car if it’s a Cat N or Cat S write-off. You must be honest enough to inform potential buyers of the write off status and category. However, you cannot sell a car with Cat A or Cat B write off status as the car cannot be repaired to be used on the road again.

Can I still buy a vehicle that has been written off?

Yes, a lot of people still go ahead with the purchase. The important thing is knowing what you’re dealing with. Cat S or N cars can be fine if repaired well, but always double-check safety, insurance, and resale value before taking the plunge.

How often should I get a car write-off check for a used vehicle?

You should get a car write off check every single time you’re considering a purchase. Even if the seller seems trustworthy, the car’s hidden history doesn’t always make it into the conversation. A quick write-off check could be the difference between finding a solid deal or ending up with a nightmare.

Is it possible to remove a write-off category from a vehicle's history?

No, once it’s written off, the label sticks forever. Even if the car has been beautifully repaired, that history doesn’t disappear. The rule exists to protect future buyers and ensure honesty about the vehicle’s past.

Can I buy an insurance write-off vehicle?

Yes, you can buy a car with Category S and N write offs if repaired and certified to be put back on the road. If your car is written off, you can buy it back. However, it’s illegal to buy a Category A or B write off.

Can I sell an insurance write-off vehicle?

Yes, only if the vehicle is in the Cat S or Cat N category. You cannot repair and resell a vehicle declared as Category A or B. You’ll need to disclose its status to avoid facing legal consequences. Be prepared for a reduced value, as many buyers are cautious about taking on previously damaged cars.

Is the write-off included on the DVLA logbook V5C?

Yes, a V5C can show a write-off. When a vehicle is written off by an insurer, they are mandated to get the DVLA aware, who then update the vehicle’s records, which includes the insurance written off status and category.

Is a car crash check the same as a write-off check?

No, they are not the same, but related. A crash check might show if a car’s been in an accident, but it won’t always say whether it was declared a write-off by an insurance company.. A car write off check goes deeper and gives you a much clearer picture of the vehicle’s history, condition, and write-off category.

Can I buy my written-off car back from my insurance company?

In many cases, yes. Insurers will pay you the settlement, then offer you the option to buy the salvage at a reduced cost. People often do this when the car has sentimental value or is worth repairing themselves.

Is it more expensive to insure a Cat S or N car?

Often, yes. Some insurers increase premiums on repaired write-offs, while others refuse to cover them at all. It depends on the company, so it’s always smart to shop around and check before committing to one.

Will my write-off car need a fresh MOT?

If the vehicle’s been repaired and is going back on the road, it’ll need to pass an MOT test first. This confirms it’s safe and roadworthy, giving you and your insurers reassurance before driving again.