Owning, buying, or selling a vehicle in the UK comes with some costs and expenses. One of which is the car tax. Ever wondered what tax band your car falls under in the UK? Having an idea of the car tax band prepares car owners and buyers for ownership costs and helps in proper budgeting.

What tax band is my car by reg? Find out now with our guide to car tax!

What is Vehicle Tax?

Vehicle tax, also known as Vehicle Excise Duty (VED) or simply car tax, is a mandatory payment imposed by the government for owning and using a vehicle on public roads in the United Kingdom. This tax is collected as a form of revenue for the government and is utilized for maintaining and improving the road infrastructure across the country.

So, how is it calculated? The amount of car tax you will pay depends on several factors including the year and month the car was first registered, the car’s fuel type, and CO2 emissions.

Another factor is inflation. Yes, inflation can cause the car road tax rates to be adjusted by the government. That’s a lot of info to take in right? We will explain further in other sections.

How Much is the Car Tax in the UK in 2025?

Just like I mentioned before, vehicle tax bands depend on when the vehicle was first registered, engine size, fuel type, emissions, and sometimes, the government. For most cars, the tax rate should be £190 but you may pay a higher or lower tax rate based on when your car was registered.

Since 1 March 2001 and April 2017, car tax bands are primarily determined by a car’s CO2 emissions. The lower the emissions, the lower the tax band and the amount you pay.

When Do You Have to Pay Your Car Tax?

In the UK, you must pay car tax (also known as Vehicle Excise Duty or VED) before you drive or park your vehicle on public roads, unless it’s officially declared off-road with a SORN (Statutory Off Road Notification).

You will need to pay car tax:

- When you buy a new or used car – it must be taxed before it’s driven.

- Annually, either in full, monthly (by Direct Debit), or every 6 months.

- When your existing tax expires – check your renewal date at gov.uk/vehicle-tax.

Late payments can result in fines, penalties, or even vehicle clamping, so it’s important to stay up to date.

How Much Do I Have to Pay for My Car Tax?

The easiest way to check the tax band of any car by reg number is using our number plate check tool. With our tool, car owners, buyers, and sellers can check the tax band/tax rate of any used/registered car within a few seconds.

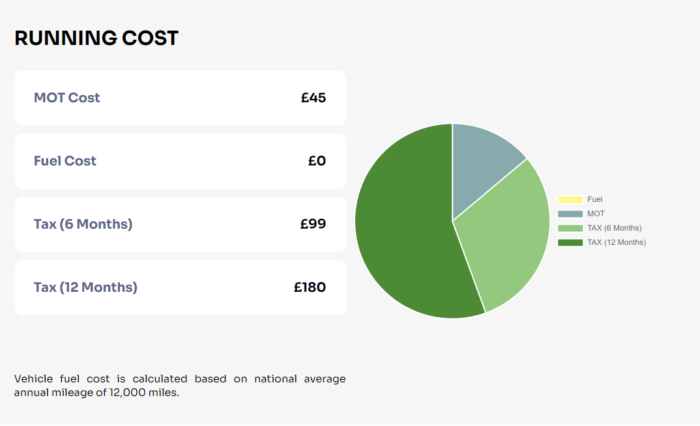

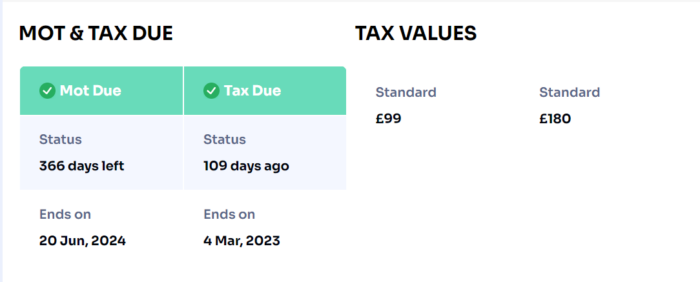

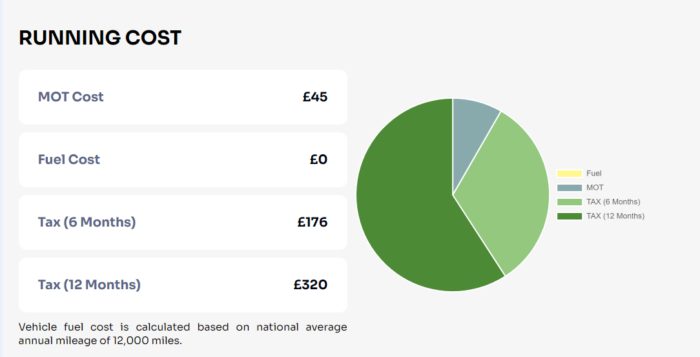

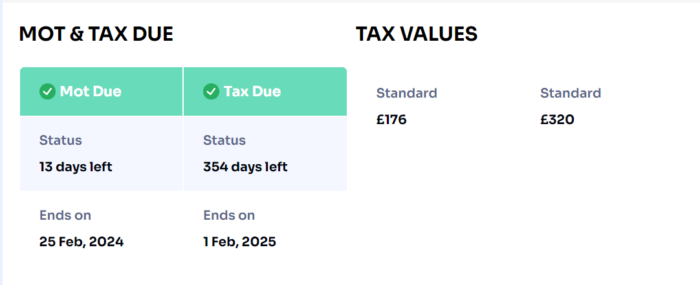

Here is a good example; We checked a 2019 KIA SPORTAGE and these are the tax records we were able to provide using the car reg number only:

We also ran a car tax check on a 2011 VAUXHALL COMBO and these are the tax records we were able to provide using the car reg number only:

To check the tax band of any car by reg, all you need to do is follow these steps:

- Locate the registration number from the license plate.

- Enter your vehicle registration to check the vehicle tax rates.

- Fill out the form and click on “Check Vehicle.”

- Receive your detailed car history report.

The detailed report will show you the specifications and history of the vehicle you are interested in, as well as the car tax rate using our car tax calculator.

How much is my car tax? Checking Current Car Tax Bands

You can also check the current car tax bands of any vehicle if you know when the vehicle was registered and its CO2 emissions in g/km. There are some additional points to consider regarding tax bands:

- Electric Vehicles (EVs) and Zero-Emission Cars: These fall into Band A (currently exempt from tax) but may be subject to a small charge from 2025 onwards.

- Older Cars (Pre-April 2001): These are taxed based on engine size, with larger engines incurring a higher vehicle tax rate.

Cars registered on or after 1 April 2017

Usually, it is mandatory to pay tax when the vehicle is first registered. This initial payment covers for 12 months. After that payment, you’ll need to pay every 6 or 12 months at a different rate.

If you have a diesel car that doesn’t meet the Real Driving Emissions 2 (RDE2), you will have to pay a higher rate. Here’s a table to guide you through the 13 bands:

CO2 emissions (g/km) | Diesel and Petrol cars that meet the RDE2 standard | All other diesel cars | Alternative fuel cars |

0 | £0 | £0 | £0 |

1 to 50 | £10 | £30 | £0 |

51 to 75 | £30 | £135 | £20 |

76 to 90 | £135 | £175 | £125 |

91 to 100 | £175 | £195 | £165 |

101 to 110 | £195 | £220 | £185 |

111 to 130 | £220 | £270 | £210 |

131 to 150 | £270 | £680 | £260 |

151 to 170 | £680 | £1,095 | £670 |

171 to 190 | £1,095 | £1,650 | £1,085 |

191 to 225 | £1,650 | £2,340 | £1,640 |

226 to 255 | £2,340 | £2,745 | £2,330 |

Over 255 | £2,745 | £2,745 | £2,735 |

Cars registered from April 1st, 2017 – Second Year

Fuel type | 12 months tax | 6 months tax |

Petrol / Diesel | £180 | £99 |

Electric Vehicle | £0 | £0 |

Alternative Fuel | £170 | £93.50 |

Note that cars with listing prices above £40,000 pay a £410 annual supplement for five years from the second year of registration but electric cars are exempt from this.

Cars registered from March 2001

For cars registered between March 2001 and April 2017, there are slightly different rates divided into 13 bands. For example, if your car falls into this category and your car releases less than 100g/km of emissions, you may not need to pay car tax.

Petrol and Diesel cars registered from March 2001

Driving a petrol or diesel car registered from March 2001, you can verify how your vehicle is taxed here:

Band and CO2 emission (g/km) | 12 months tax | 6 months tax |

A: Up to 100 | £0 | – |

B: 101 to 110 | £20 | – |

C: 111 to 120 | £35 | – |

D: 121 to 130 | £150 | £82.50 |

E: 131 to 140 | £180 | £99 |

F: 141 to 150 | £200 | £110 |

G: 151 to 165 | £240 | £132 |

H: 166 to 175 | £290 | £159.50 |

I: 176 to 185 | £320 | £176 |

J: 186 to 200 | £365 | £200.75 |

K: 201 to 225 | £395 | £217.25 |

L: 226 to 255 | £675 | £371.25 |

M: Over 255 | £695 | £382.25 |

Alternative fuel cars registered from March 2001

Band and CO2 emission (g/km) | 12 months tax | 6 months tax |

A: Up to 100 | £0 | – |

B: 101 to 110 | £10 | – |

C: 111 to 120 | £25 | – |

D: 121 to 130 | £140 | £77 |

E: 131 to 140 | £170 | £93.50 |

F: 141 to 150 | £190 | £104.50 |

G: 151 to 165 | £230 | £126.50 |

H: 166 to 175 | £280 | £154 |

I: 176 to 185 | £310 | £170.50 |

J: 186 to 200 | £355 | £195.25 |

K*: 201 to 225 | £385 | £211.75 |

L: 226 to 255 | £665 | £365.75 |

M: Over 255 | £685 | £376.75 |

Cars and vans registered before March 2001

Engine size (cc) | 12 months tax | 6 months tax |

1549cc or lower | £200 | £110 |

More than 1549cc | £325 | £178.75 |

Motorhomes weighing 3.5 tonnes or less

Engine size (cc) | 12 months tax | 6 months tax |

1549cc or lower | £200 | £110 |

More than 1549cc | £325 | £178.75 |

Motorhomes weighing more than 3.5 tonnes

12 months tax | 6 months tax |

£165 | £90.75 |

To check the tax band of any car by reg, all you need to do is follow these steps:

Locate the registration number from the license plate.

Enter your vehicle registration to check the vehicle tax rates.

Fill out the form and click on “Check Vehicle.”

Receive your detailed car history report.

The detailed report will show you the specifications and history of the vehicle you are interested in, as well as the car tax rate using our car tax calculator.

How Do I Find the Tax Band For My Car?

You can also check the current car tax bands of any vehicle if you know when the vehicle was registered and its CO2 emissions in g/km. There are some additional points to consider regarding tax bands:

- Electric Vehicles (EVs) and Zero-Emission Cars: These fall into Band A (currently exempt from tax) but may be subject to a small charge from 2025 onwards.

- Older Cars (Pre-April 2001): These are taxed based on engine size, with larger engines incurring a higher vehicle tax rate.

Cars registered on or after 1 April 2017

Usually, it is mandatory to pay tax when the vehicle is first registered. This initial payment covers for 12 months. After that payment, you’ll need to pay every 6 or 12 months at a different rate.

If you have a diesel car that doesn’t meet the Real Driving Emissions 2 (RDE2), you will have to pay a higher rate. Here’s a table to guide you through the 13 bands:

CO2 emissions (g/km) | Diesel and Petrol cars that meet the RDE2 standard | All other diesel cars | Alternative fuel cars |

0 | £0 | £0 | £0 |

1 to 50 | £10 | £30 | £0 |

51 to 75 | £30 | £135 | £20 |

76 to 90 | £135 | £175 | £125 |

91 to 100 | £175 | £195 | £165 |

101 to 110 | £195 | £220 | £185 |

111 to 130 | £220 | £270 | £210 |

131 to 150 | £270 | £680 | £260 |

151 to 170 | £680 | £1,095 | £670 |

171 to 190 | £1,095 | £1,650 | £1,085 |

191 to 225 | £1,650 | £2,340 | £1,640 |

226 to 255 | £2,340 | £2,745 | £2,330 |

Over 255 | £2,745 | £2,745 | £2,735 |

Cars registered from April 1st, 2017 – Second Year

Fuel type | 12 months tax | 6 months tax |

Petrol / Diesel | £180 | £99 |

Electric Vehicle | £0 | £0 |

Alternative Fuel | £170 | £93.50 |

Note that cars with listing prices above £40,000 pay a £410 annual supplement for five years from the second year of registration but electric cars are exempt from this.

Cars registered from March 2001

For cars registered between March 2001 and April 2017, there are slightly different rates divided into 13 bands. For example, if your car falls into this category and your car releases less than 100g/km of emissions, you may not need to pay car tax.

Petrol and Diesel cars registered from March 2001

Driving a petrol or diesel car registered from March 2001, you can verify how your vehicle is taxed here:

Band and CO2 emission (g/km) | 12 months tax | 6 months tax |

A: Up to 100 | £0 | – |

B: 101 to 110 | £20 | – |

C: 111 to 120 | £35 | – |

D: 121 to 130 | £150 | £82.50 |

E: 131 to 140 | £180 | £99 |

F: 141 to 150 | £200 | £110 |

G: 151 to 165 | £240 | £132 |

H: 166 to 175 | £290 | £159.50 |

I: 176 to 185 | £320 | £176 |

J: 186 to 200 | £365 | £200.75 |

K: 201 to 225 | £395 | £217.25 |

L: 226 to 255 | £675 | £371.25 |

M: Over 255 | £695 | £382.25 |

Alternative fuel cars registered from March 2001

Band and CO2 emission (g/km) | 12 months tax | 6 months tax |

A: Up to 100 | £0 | – |

B: 101 to 110 | £10 | – |

C: 111 to 120 | £25 | – |

D: 121 to 130 | £140 | £77 |

E: 131 to 140 | £170 | £93.50 |

F: 141 to 150 | £190 | £104.50 |

G: 151 to 165 | £230 | £126.50 |

H: 166 to 175 | £280 | £154 |

I: 176 to 185 | £310 | £170.50 |

J: 186 to 200 | £355 | £195.25 |

K*: 201 to 225 | £385 | £211.75 |

L: 226 to 255 | £665 | £365.75 |

M: Over 255 | £685 | £376.75 |

Cars and vans registered before March 2001

Engine size (cc) | 12 months tax | 6 months tax |

1549cc or lower | £200 | £110 |

More than 1549cc | £325 | £178.75 |

Motorhomes weighing 3.5 tonnes or less

Engine size (cc) | 12 months tax | 6 months tax |

1549cc or lower | £200 | £110 |

More than 1549cc | £325 | £178.75 |

Motorhomes weighing more than 3.5 tonnes

12 months tax | 6 months tax |

£165 | £90.75 |

Why Do I Need to Pay Tax?

Earlier we talked about Vehicle Excise Duty and explained what it is – a tax for using a vehicle on the UK roads. So, why is it necessary to pay?

Taxes are the primary way governments raise money. This money is then used to fund a wide range of essential public services and infrastructure that benefit everyone. Road tax may not be used for the roads specifically. They may be used to fund social programs, schools, healthcare, and more.

Exemptions and Free Car Tax Bands: Who is Exempt From Paying Tax?

Looking for tax exemptions? Here are a few vehicles that are currently exempt from vehicle tax. Remember, however, that you shouldn’t be found driving an untaxed vehicle and would have to apply for car tax exemptions:

- Electric vehicles with zero emissions

- Mowing machines

- Agricultural vehicles

- Historic vehicles (at least 40 years old)

- Disabled passenger vehicles

- Mobility scooters, powered wheelchairs and invalid carriages

- Steam vehicles

If you want to be sure if your vehicle is exempt from tax costs, you can use our car check tool. Remember that you also need to tax your vehicle, even if you don’t have to pay anything. This allows you to meet the legal requirements for drivers to use the UK roads.

How Do I Tax My Car?

Now that you understand the car tax rates, how do you pay tax? You can choose to pay online, at the post office, or over the phone.

- Online: Visit the gov.uk portal, navigate to the road tax section, and follow the instructions to pay with your credit card or Direct Debit. You can always track your vehicle’s tax status and due date with our road tax check tool.

- At the Post Office: To pay tax at the post office, all you need to do is visit your local post office and go with the documents listed above. The DVLA V11 reminder, the green “new keeper” slip from a logbook, and a valid MOT test certificate. Don’t forget to go with cash or a debit card for payment. You can also pay via Direct Debit.

- Over the Phone: The final option is over the phone. Simply dial 0300 123 4321 to complete your road tax application online. Note that you cannot pay via Direct debit over the phone.

What Documents Do I Need To Tax My Car?

During the application process, you will be required to provide some information and documents. You must ensure that these documents are ready, as they may impede the process:

- A vehicle logbook (V5C) registered in your name

- A recent V11 reminder or “last chance” warning letter from the Driver and Vehicle Licensing Agency (DVLA)

- The green “New Keeper” slip, if your vehicle was recently purchased.

- A valid MOT certificate

- An exemption certificate, if you claim disabled vehicle tax

- A copy of your certificate of insurance, if you reside in Northern Ireland.

If none of these documents are available, you would need to apply for a new logbook.

What Happens If I Don’t Tax My Car?

If you don’t tax your vehicle and it’s not declared off the road (SORN), you should expect to face some serious consequences since you are literally going against the law. Here’s what you can expect if you don’t tax your car:

- Automatic Fines: The DVLA can issue an £80 penalty, even if the car isn’t being driven.

- Enforcement Action: You can expect your vehicle to be either clamped, towed, or even crushed, all of which you want to avoid.

- Court Fines: If it goes on for too long, you could be fined up to £1,000.

- No Tax Refunds: Finally, you won’t be eligible for any tax refund for the unused period.

It’s easier to ensure your car is taxed than to face all the consequences of driving an untaxed car.

Conclusion

In conclusion, by understanding how car tax works, checking your vehicle’s tax band, and staying informed about tax regulations, you can ensure compliance with the law and avoid unnecessary penalties.

If you’re unsure of a vehicle’s current tax status, a road tax check can help you with the current tax status, tax rate, payment due date, and more.

Frequently Asked Questions on Road Tax Bands

Can I tax a car without insurance?

No, you can’t tax a car in the UK without valid insurance. The DVLA automatically checks the Motor Insurance Database during the tax process.

What are the legal driving requirements in the UK?

To legally drive a car in the UK, you need to have a valid driving licence, an up-to-date car tax (unless it’s declared SORN), and insurance that covers at least third-party liability.

Can I tax a car without a V5C logbook?

Yes, if you don’t have the V5C, you can use a V11 reminder letter or apply for a V62 form (replacement logbook), though this may cause the process to be delayed.

Can you insure a car without tax?

Yes, you can insure a car without tax. In fact, you need to have insurance before you can tax a vehicle.

Can I drive a car home without tax if I’ve just bought it?

No, you generally cannot legally drive a newly purchased car home without paying the necessary taxes and completing at least temporary registration.

How soon can I tax a car?

You can tax your vehicle as early as two months before it is due using Direct Debit. If the vehicle is brand new, it has to be taxed on the day it is purchased or registered.

Can you use temporary car insurance in order to tax a car?

Yes. As long as the temporary insurance is active and shows on the Motor Insurance Database, it’s valid for taxing the car.

How long does it take for car tax to be registered?

Tax is usually registered immediately online or at a Post Office and as soon as the process is completed, the vehicle status updates quickly on the DVLA system.

Can you ever drive a car legally without tax?

Yes, but only in rare cases like driving to a pre-booked MOT if the vehicle is insured or if the vehicle is tax exempt. Otherwise, driving on public roads without tax is illegal.

How can I check if a car has been taxed?

You can check if a car is taxed with a car tax check. With this, you can verify tax status, tax rate, payment due date, and other vehicle specifications and history records.

How can I report an untaxed car anonymously?

There is a dedicated page on the DVLA website where you can report an untaxed vehicle. Take note of the vehicle’s registration number, make, model, and colour. Also, take note of the postcode where you saw the vehicle and submit the report. Note that no personal information is required.

When might I not have to pay car tax?

You may not need to pay car tax if your vehicle is fully electric, over 40 years old (historic vehicles), or adapted for disabled drivers.

How do I cancel my car tax to get a refund?

To cancel your vehicle tax, you need to inform the DVLA that you no longer have a vehicle or it’s off the road and the exact reason why. After telling the DVLA, your vehicle tax will be cancelled, and if you pay bu Direct Debit, it will be cancelled automatically. You’ll also automatically receive a refund cheque for any full months left on your vehicle tax.

What happens if I drive without tax?

You could face and £80 fine, court prosecution with fines up to £1,000, as well as clamping, towing, or impounding of your vehicle.

What is the cheapest car to tax?

The cheapest cars to tax are cars with low CO₂ emissions, like electric or hybrid vehicles. Some may even qualify for £0 annual tax.

Why can’t I find my vehicle on the car tax checker?

If you can’t find your vehicle on the car tax checker, it means your vehicle may be recently purchased (brand new), with no data updated yet. Another reason is you may have entered the wrong registration number.

Why is my tax expiry date incorrect?

It could be due to:

- A delay in payment processing

- A recent SORN or ownership transfer

- DVLA system sync issues (usually resolves within a day or two)

How will I know when my road tax expires?

You’ll receive a V11 renewal reminder from the DVLA by post or email to remind you when your road tax expires. You can also check anytime with the road tax checker on this page.