Car Tax Bands

Enter your vehicle registration into our free car tax check tool to instantly verify the tax rates, CO2 emissions, and band. You should check the latest vehicle tax rates from the DVLA to confirm the tax band of your vehicle.

- Lowest price check

- Great Customers Review

- Fast and Accurate

- Lowest price check

- Great Customers Review

- Fast and Accurate

What is Car Tax or VED in the UK?

Car tax, or Vehicle Excise Duty (VED), is a mandatory tax on vehicles using UK public roads, collected by the Driver and Vehicle Licensing Agency (DVLA). The cost depends on CO₂ emissions, fuel type, age, and vehicle price.

Cars registered before April 2017 are mainly taxed on official CO₂ emissions, while newer cars follow updated banding rules. Electric vehicles often pay little or nothing. VED can be paid yearly, every six months, or monthly, with penalties for non-compliance.

What are VED Rates, and How is VED Calculated?

VED rates are the amounts of Vehicle Excise Duty (road tax) you pay to keep and use a vehicle on UK roads. The rate depends on factors such as when the car was registered, its CO2 emissions, fuel type, and sometimes its list price.

Here’s a clear, practical way to calculate (count) VED with worked examples using GOV.UK rates effective from 1 April 2025.

Steps to Calculate VED

- Find the vehicle’s first registration date (this decides which tax table applies).

- Get the vehicle’s CO₂ (g/km) figure and fuel type (petrol/diesel/zero).

- Look up the correct rate table: Cars registered on/after 1 Apr 2017: first-year (graduated by CO₂), then a flat standard annual rate from the second year. Cars registered 1 Mar 2001 to 31 Mar 2017: use the older CO₂ band table.

- Apply any extras: an expensive-car supplement applies if the list price > £40,000 (applies from the second licence for 5 years). Diesel vehicles not meeting RDE standards can pay higher first-year amounts.

- Total the relevant line(s) for the year you’re calculating.

Example A:

Petrol car, registered 2025, CO₂ 120 g/km, list price £35,000

- First year (CO₂ 111–130): £440 (first-year).

- Year 2 onwards (standard): £195 per year.

Example B:

Same petrol car but list price £45,000 (expensive supplement applies)

- Year 1 = £440.

- Year 2 = standard £195 + supplement £425 = £620. (195 + 425 = 595; 595 + 25 = 620).

Example C:

Electric (zero-emission) car registered on/after 1 Apr 2025

- First year = £10; Year 2 onwards = £195 (standard).

Example D:

Older car (registered 2010) CO₂ 150 g/km (band F)

- Annual VED = £215 (per the older band table).

How Do I Find the Tax Band For My Car?

You can find your car tax band (VED band) by using our free car tax check tool. Follow these easy steps:

Step 1: Enter the Registration Number or VIN

Enter the car’s registration number or VIN into the form at the top of the page.

Step 2: Start Search

Click “search” to begin. You’ll get details like the year, make, model, colour, fuel type, engine size, and more. This helps confirm the car is truly what the seller says.

Step 3: View Tax Band and Other Vehicle Details

Scroll down to verify the tax details and CO2 Emission band. To view the full car history, including finance check, MOT history, stolen checks, and more, pay a small fee to access the car check report.

You can also find your car’s tax band through the following:

- Check your V5C logbook: This lists the CO₂ emissions, which determine the tax band for cars registered before April 2017. You can also get a log book check online to see the V5C details, including tax and MOT status.

- Visit the DVLA website: Use the DVLA vehicle enquiry service by entering your registration number to see your tax details for free.

- Look at your renewal reminder (V11): This is sent by DVLA before your tax is due, showing your current rate.

- Ask your dealership: If it’s a new or used car, the dealer can also help to confirm the correct tax band.

How Much Is My Car Tax In 2025

Your car tax is based on the emission bands, registration date, and price. For instance, if you buy a petrol car in 2025 (post-2017) with CO₂ = 120 g/km, the first-year tax is £440.

After that, you pay £195/year (unless the car costs more than £40,000 new, then an extra supplement for years 2-6). If you buy an older car registered in 2010 with emissions of 95g/km, your annual tax is £20.

Tax bands for cars registered before 1 March 2001

Cars first registered before 1 March 2001 are taxed differently from modern vehicles. Instead of CO₂ emissions, their tax bands are based purely on engine size.

Here’s a table showing the 6-month and 12-month tax rates for cars registered before 1 March 2001, based on engine size.

| Engine size (cc) | 12-month tax | 6-month tax |

|---|---|---|

| Not over 1549 cc | £200 | £110 |

| Over 1549 cc | £325 | £178.75 |

Tax bands for cars registered after April 2017

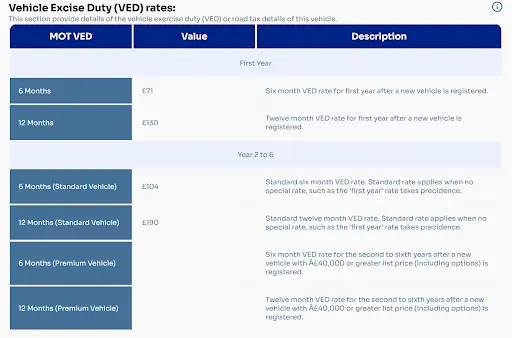

Cars registered after April 2017 follow a different Vehicle Excise Duty (VED) system, with first-year rates based on emissions and flat standard rates afterward. Here’s a table to show how the bands work:

| CO₂ emissions (g/km) | First-year rate | Standard annual rate (from year 2) |

|---|---|---|

| 0 | £10 | £195 |

| 1 - 50 | £110 | £178.75 |

| 51 - 75 | £130 | £195 |

| 76 - 90 | £270 | £195 |

| 91 - 100 | £350 | £195 |

| 101 - 110 | £390 | £195 |

| 111 - 130 | £440 | £195 |

| 131 - 150 | £540 | £195 |

| 151 - 170 | £1,360 | £195 |

| 171 - 190 | £2,190 | £195 |

| 191 - 225 | £3,300 | £195 |

| 226 - 255 | £4,680 | £195 |

| Over 255 | £5,490 | £195 |

Car Tax Bands for Vehicles Over £40,000 List Price

Here are the details for the Expensive Car Supplement (also called the “luxury car tax”) in the UK for vehicles with a list price over £40,000 as of April 2025.

Steps to Calculate VED

- If a car’s list price when new exceeds £40,000, an extra £425/year is added to its annual Vehicle Excise Duty (VED) from year 2 to year 6 of its ownership.

- This applies to all fuel types, including electric/zero-emission cars registered on or after 1 April 2025. EVs had previously been exempt, but that ended with the changes on 1 April 2025.

- The extra is on top of the standard VED rate.

| Registration date | Fuel / Emission Type | Year 1 (first-year VED / "showroom tax") | Standard annual VED (from Year 2) | VED, including expensive car supplement (Years 2-6) |

|---|---|---|---|---|

| On or after 1 April 2017 | Any (petrol/diesel/hybrid / zero emission) | Varies by CO2 emissions ("first-year rate"), e.g., 0g/km = £10, 1-50g/km = £110, etc. | Standard rate: £195/year for most cars registered from 2017 onwards. | £195 + £425 = £620/year during years 2-6 of ownership. |

| Electric / zero emission, registered 1 April 2025 or later | EV / ZEV | First year: £10 (for 0 CO2 emissions) | £195/year from the second year onwards | £620/year (i.e., £195 + £425) for years 2-6, if the list price exceeded £40,000. |

When Do You Have To Pay Your Car Tax?

Knowing when to pay your car tax is essential to staying legal and avoiding penalties. Here are the key times you must ensure your vehicle is taxed:

- Before driving on public roads: Your car must be taxed (or declared SORN) before you use or park it on public roads.

- Annually, biannually, or monthly: You can choose to pay your Vehicle Excise Duty (VED) every 12 months, every 6 months, or by monthly Direct Debit.

- On renewal date: You’ll receive a DVLA reminder (V11) before your tax expires, and payment must be made by the due date.

- When buying a car: Tax doesn’t transfer with ownership. A new keeper must tax the vehicle immediately using the V5C logbook or new keeper slip. You can run a quick car tax check to verify the car tax status and the VED rates (6 & 12 months).

- If tax class changes: For example, switching to the disabled tax class or changes in the CO₂ band, you must re-tax the vehicle at that time.

How do I Pay for My Car Tax?

Paying your car tax (Vehicle Excise Duty) is straightforward. Follow the steps below to tax online, by phone, at a Post Office, or set up Direct Debit.

Gather what you need

Collect your reference number from V5C, V5C/2, or V11, and ensure valid MOT and insurance are available.

Pay online (fastest)

Visit GOV.UK, enter your reference, choose payment terms, and pay securely using debit, credit card, or Direct Debit.

Pay by phone

Call HMRC on 0300 123 4321, provide your reference number, then pay instantly using a debit or credit card.

Set up or change Direct Debit

Choose monthly, six-monthly, or yearly instalments. Be aware that a 5% surcharge applies to monthly or six-monthly, but not annual payments.

What Cars are Exempt from the Car Tax?

Some vehicles qualify for full or partial Vehicle Excise Duty (VED) exemptions. Below are common questions and answers explaining which cars or drivers are exempt from paying car tax.

Classic Cars

Vehicles over 40 years old are exempt, provided they’re registered as “historic vehicles” with the DVLA.

Electric Cars

Fully electric cars were exempt, but from April 2025, they must pay standard car tax and, if over £40,000, the supplement.

Disabled Drivers

Vehicles used by disabled drivers or registered in the “disabled” tax class may qualify for free or reduced VED.

Hybrids or Low-Emission Vehicles

Some may benefit from lower first-year rates depending on CO₂ emissions.

Agricultural Vehicles

Tractors, agricultural machines, and some off-road vehicles are exempt if they’re only used for farming purposes.

SORN Vehicles

Vehicles declared off the road with a Statutory Off Road Notification (SORN) do not require tax until driven again.

Frequently Asked Questions About Car Tax Bands

What happens if I don’t tax my car?

If you don’t tax your car, you risk an £80 fine, wheel clamping, or vehicle seizure. Continuous Vehicle Licensing rules mean DVLA automatically checks records, so driving untaxed can also lead to prosecution.

What happens to your road tax when you sell your car?

When you sell your car, any remaining road tax is automatically cancelled, and the unused months are refunded to you. The buyer must immediately re-tax the vehicle before using it.

What is the first tax payment when you register the vehicle?

When registering a new car, the first tax payment, called the “first-year rate,” is based on the vehicle’s CO₂ emissions. Dealers usually arrange this tax payment at the time of purchase.

What are the rates for second tax payment onwards?

From the second year onwards, most cars registered after April 2017 pay a flat standard annual rate. An extra supplement applies if the car’s list price exceeded £40,000 when new.

Do you need to pay tax if your car is declared off-road with a SORN?

If your vehicle is declared off-road with a Statutory Off Road Notification (SORN), you don’t need to pay tax. However, it cannot be driven or parked on public roads legally.

Can I pay car tax with a Direct Debit?

Car tax can be paid by Direct Debit annually, six-monthly, or monthly. Monthly and six-monthly payments include a small surcharge, while annual Direct Debit payments are charged at the standard rate.

Who doesn’t have to pay car tax?

Vehicles exempt from car tax include those over 40 years old, disabled tax class vehicles, mobility scheme vehicles, and certain agricultural machines. However, you still need to apply for exemption status.

When can I stop paying car tax?

You stop paying car tax if your vehicle becomes exempt, is declared SORN, or you sell it. The DVLA automatically issues refunds for any remaining full months of unused tax.

When can I drive an untaxed car?

You can only drive an untaxed car if you’re heading to a pre-booked MOT, repair appointment, or DVLA inspection. At all other times, driving untaxed is illegal and subject to penalties.

How do I declare a car off-road?

You can declare a car off-road by submitting a Statutory Off Road Notification (SORN) through GOV.UK, by phone, or post. This makes the vehicle exempt from tax until re-licensed.

Do I need to pay car tax for an electric car?

Yes. From April 2025, fully electric vehicles pay the same standard annual tax as petrol and diesel cars. Expensive car supplements also apply if the original list price exceeded £40,000.

What if I’ve been fined unfairly?

If unfairly fined for car tax, you can challenge it by contacting the DVLA with supporting evidence. Provide proof of payment, SORN status, or exemption details to request cancellation or appeal.

Can I get a refund on tax if I sell a car?

Yes. When you sell your car, DVLA automatically cancels your tax and refunds the full unused months directly to your bank account. Refunds exclude part-month payments or Direct Debit surcharges.

Does tax get transferred when buying a car?

No. Road tax does not transfer with the vehicle. Buyers must tax the car immediately after purchase using the V5C/2 new keeper slip, online, phone, or Post Office service.

What decides how much car tax I pay?

Car tax is decided by your car’s registration date, CO₂ emissions, fuel type, and list price. Newer cars pay standard rates, while older vehicles often use emissions-based tax bands.

What car tax changes took effect in 2025?

From April 2025, electric cars lost their VED exemption, and the expensive car supplement applies to all fuels. Some CO₂-based first-year rates were also adjusted to reflect emission categories.

Electric car tax changes for 2025

Electric cars registered from April 2025 must pay the standard annual car tax of £195, plus the £425 expensive car supplement if the vehicle’s list price exceeds £40,000.

Why is car tax changing?

The car tax is changing to ensure fairness as more drivers switch to electric vehicles. The government aims to maintain revenue and apply equal road usage taxation across all fuel types.