Taxing a car is something every driver in the UK must do. But what happens if you do not have the V5C logbook? Many people lose it, never get it from the seller, or simply cannot find it when it is time to tax their car.

The good news is this: you can still tax your car without the V5 in many cases. You just need to follow the right steps.

This guide will explain what the V5C is, why it is important, how to tax a car without it, and how to get a replacement if yours is missing.

So as not to risk fines or surprises, you can get a quick car tax check service to help confirm a vehicle’s tax status in seconds. This ensures you stay informed, legal, and drive with confidence on public roads.

KEY TAKEAWAYS

- You can still tax a car without a V5C by using a V11 reminder letter, a green new keeper slip, or visiting a Post Office that handles vehicle tax.

- You can quickly apply for a replacement logbook using the V62 form. It costs £25, and the DVLA usually issues the new V5C within 4–6 weeks.

- Driving without tax is illegal and can lead to fines of £1,000 or wheel-clamping. Even without a V5C, you must tax the vehicle before driving.

What is a V5C Logbook?

The V5C logbook is an official paper document from the DVLA. It proves who is the registered keeper of the car. This does not always mean the keeper is the legal owner. It simply means the DVLA knows who is responsible for the car day-to-day.

The V5C holds key details about the vehicle, such as:

- Car make and model

- Colour

- Engine size

- Fuel type

- CO₂ emissions

- Year of first registration

- VIN (Vehicle Identification Number)

- Keeper’s name and address

V5C has to be updated whenever you purchase, sell, scrap, or modify details of your car. When you change address, change your name, or make any amendments to the vehicle, you need to inform the DVLA using the details of your logbook.

In the event that you are purchasing a used vehicle, a logbook check can be used to avoid fraud by comparing the car details with the official records and ensuring that you are not purchasing a car with a fraudulent history.

What is Road Tax?

Tax on the road is formally known as Vehicle Excise Duty (VED). You have to pay tax on your car in order to drive or park it on public roads. When the vehicle is not on the road and not in use, you have to declare a SORN (Statutory Off Road Notification) so you don’t have to pay tax.

The tax rate you pay depends on:

- The car’s CO₂ emissions

- The type of fuel it uses (petrol, diesel, hybrid)

- When it was first registered

You must renew your car tax every year. You can pay monthly, six-monthly, or annually. Even if you do not receive a reminder letter, you are still responsible for keeping your car taxed.

READ ALSO: UK Car Tax Changes 2025

How to Tax a Car Without a V5: Step-by-Step Guide

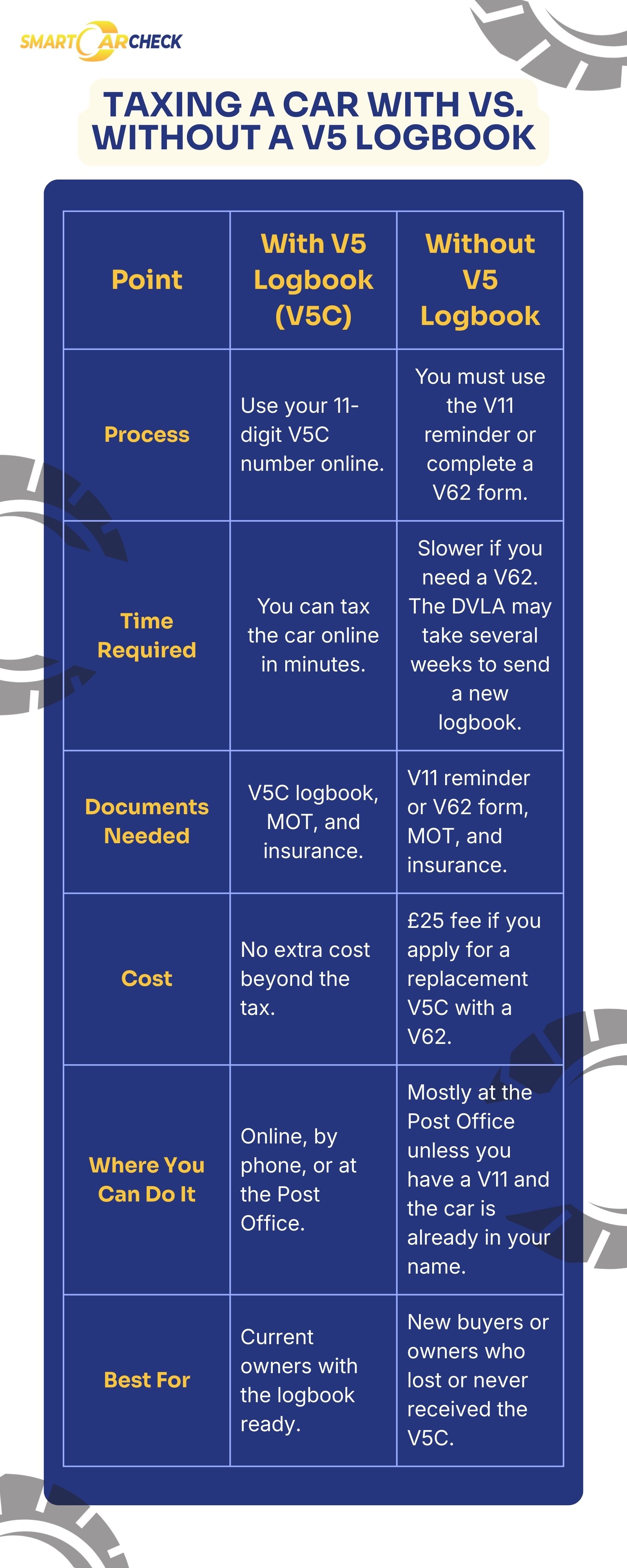

Many people think they cannot tax a car without the V5C logbook, but that is not always true. There are two main ways to tax your car without the logbook.

Use a V11 Tax Reminder Letter

If you have received a V11 reminder letter from the DVLA, you can tax the car online, by phone, or at the Post Office. This is the easiest way to tax a car without V5.

The V11 letter includes:

- Your reference number

- Your vehicle details

- Your tax expiry date

With the V11 reminder, you do not need the V5C logbook.

Tax at the Post Office Using a V62 Form

If you do not have the V5C or the V11, you can still tax the car at a Post Office that handles vehicle tax.

You will need:

- A completed V62 form (application for a replacement logbook)

- Your MOT certificate (if required for your car’s age)

- £25 fee for the V62

- Your proof of identity (recommended)

The Post Office will process both your vehicle tax and replacement V5C request. This means the car gets taxed straight away, and the DVLA sends your new V5C by post once it is ready.

When You Cannot Tax a Car Without the V5

There are a few cases where you cannot tax the car until you get a new logbook:

- You just bought a used car, and the seller did not give you the green “new keeper slip.”

- The DVLA does not have your details as the new keeper

- The car details do not match DVLA records

- The car has no valid MOT

- The car is listed as stolen, scrapped, or exported

In these cases, you must first apply for a replacement V5C before you can tax the car.

READ ALSO: Find Out if You Can update your vehicle logbook online

What is the Main Purpose of the V5C Logbook

The V5C is one of the most important documents for any vehicle owner. These are the four key purposes:

Proves You Are the Registered Keeper

The V5C displays the legal owner of the car. This is important in issues such as speeding fines, parking tickets, toll fees, and receiving official letters from the DVLA. It also assists in protecting you in case the car is used by another person. The absence of the V5C logbook makes it more difficult to prove the ownership of the car.

Confirms Vehicle Details

Important details such as VIN number, make, model, engine size, colour, fuel type, and emission levels are provided in the logbook. This is useful during the purchase of insurance, when ordering spare parts, and when it is necessary to know whether something has changed in the car.

Required for Selling or Buying a Car

You cannot fully transfer ownership without the V5C. The seller must complete the logbook details and give the buyer the green new keeper slip. The DVLA must then be informed about the ownership change. Without this process, the buyer may not be recognised as the keeper, which can lead to legal or insurance problems.

Required for Taxing, SORN, and Updating Records

You require the V5C to tax the car, declare it off-road (SORN), change address, change name, or report any changes such as colour or engine changes. The V5C is used by the DVLA to maintain the vehicle record up to date, and without it, a lot of services cannot be done.

How to Apply for a Replacement V5C Registration

If you do not have the V5C and need one, the DVLA makes it easy to get a replacement by filling out the V62 form.

You should apply for a new V5C if:

- You lost it

- It was stolen

- It is damaged or unreadable

- You never received it after buying the car

- The details are wrong

How to Apply Using a V62 Form

The V62 form is the official DVLA application for a replacement logbook. You can download it from the GOV.UK or pick one up from the Post Office. You will also be required to pay a £25 fee

You can send it by post or apply through the Post Office when taxing your car. If you are the current keeper and your details have not changed, you can complete the application online, which is the fastest option.

A replacement V5C arrives within 5 working days when applying online. An application by post usually takes up to 6 weeks.

Final Thoughts About Taxing a Car without a V5

It can be stressful to tax a car without a V5C, but it is not difficult when you are aware of the proper procedure. You can still stay legal and not be fined by using the V11 reminder, the green new keeper slip, or applying for a replacement logbook.

Always check and recheck your information and keep a record of significant documents to ensure you’re not caught off-guard when it’s time to tax your car.

Frequently Asked Questions About How to Tax Car Without V5

Can you tax a car without a V5?

Yes, taxing a car without a V5C is possible when the car owner has the 12-digit V11 reminder letter or the green new keeper slip (V5C/2). In case you do not have either, you are required to get a replacement V5C first.

Can I sell my car without a V5C?

It is not illegal to sell a car without a V5C, but it is more difficult, and the purchasers might pay less. The purchaser will have to apply for a new logbook. Offering a V5C helps simplify the sale, increases the car safety, and makes the sale more credible.

Can I tax my car before a replacement logbook arrives?.

Until you receive the V11 reminder or the new V5C, you cannot tax the car. DVLA does not accept the application receipt alone to tax a car. Hence, you have to wait until one of these documents is received.

How long does it take to get a replacement V5C?

A replacement V5C normally takes about five working days for an online application and up to six weeks by post. More time might be needed by the DVLA if your details need manual verification or if there are delays during peak season.

Can I drive my car while waiting for the replacement V5C registration?

Yes, you can drive the car while waiting for the new V5C, but only if the car is already taxed and insured. If the tax has expired, you must wait for the new logbook to tax the car before driving.