The UK has carried out certain modifications to the car taxation policies in April 2025, and the reforms affect nearly every car owner. You can drive a petrol car, a diesel car, a hybrid car, or an electric vehicle (EV), but you should be aware of what is developing, how much you will probably pay, and what you will need to do not to be caught on the wrong side of the law.

These changes in car tax may affect your running expenses, purchase decisions, and ownership plans. This guide provides everything you need to know about the UK car tax changes 2025, and what to expect.

We also have a car tax check tool, which helps you easily check whether a vehicle is taxed or not. When driving an untaxed car on a public road, it is illegal, and you can be subjected to serious consequences such as fines of £1000, clamping, or prosecution.

- Electric cars will no longer be tax-free from April 2025. They will pay the standard £10 first-year VED and £195 a year after that, the same as most petrol and diesel cars.

- Petrol, diesel, and hybrid cars registered after April 2025 will all move to a flat standard rate of £195 per year (from the second year, regardless of CO₂ output. Low-emission discounts will no longer apply.

- Expensive car supplement rules still apply. Any car, including EVs, costing over £40,000, will pay an extra £425 a year for five years, starting from the second year of registration.

What is Car Tax or VED?

Car tax, also called Vehicle Excise Duty (VED), is a yearly tax you must pay to drive or park your car on UK roads. It applies to almost all vehicles, no matter the age, size, or fuel type.

In the past, the amount you paid depended mostly on:

- Year of vehicle’s registration (accessible from the V5C log book)

- CO₂ emissions (Tax band)

- Fuel type (petrol, diesel or hybrid)

- Engine size

- Vehicle price

Cars with higher emissions were taxed more, while low-emission cars and electric vehicles often paid less or nothing at all. Brand-new cars had a separate “first-year rate” that was higher for polluting cars.

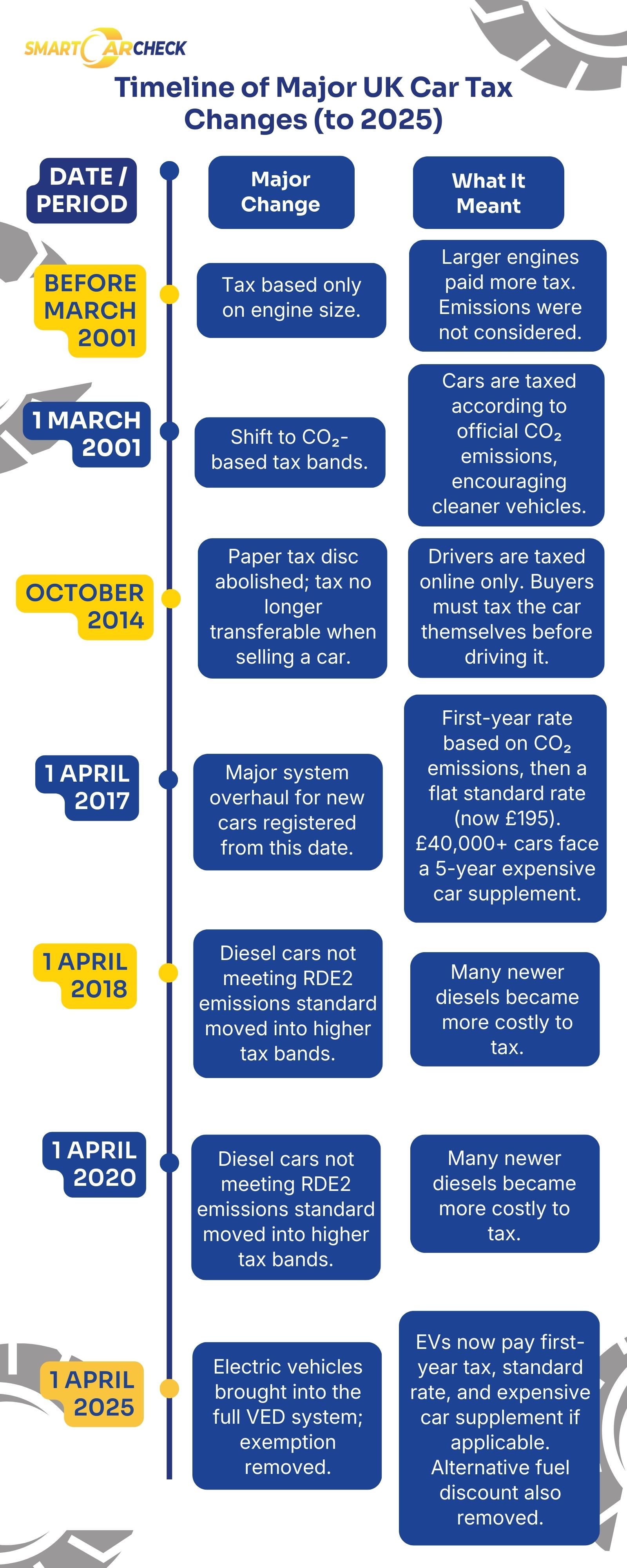

Because UK driving habits and the car market are changing, the government reviews the VED system every few years. The 2025 changes are one of the biggest updates in years and will affect millions of drivers.

READ ALSO: What Tax Band Is My Car By Reg? | Check Car Tax Bands

New Car Tax Rates in April 2025

In April 2025, the government introduced a more balanced and modernised car tax system, also called Rachel Reeves car tax changes. One of the biggest updates is that electric cars will lose their VED exemption and will be taxed in the same way as petrol, diesel, and hybrid cars. The goal is to make the system fair for all drivers as EVs become more common.

The standard VED rate for most cars will now apply across almost every fuel type. First-year rates will continue to be based on emissions, but the bands and costs are being adjusted. This means some car owners may see increases in their yearly charges, while others may see no major change.

Older vehicles, especially those with higher emissions, are expected to see bigger rises in cost. Smaller, low-emission petrol cars may see only slight changes. The updates are designed to encourage cleaner driving while keeping the overall system fair as the number of EVs grows.

EVs will no longer be fully exempt: from April 2025, they’ll pay VED, starting at £10 first-year and then £195 yearly.

Changes for Petrol, Diesel and Hybrid Cars

Petrol and diesel cars have always paid VED, but the new rules make the system simpler and more uniform. The first-year rate for high-polluting petrol and diesel cars will likely increase, while low-emission petrol engines may see a smaller change. Most cars will pay a standard rate from their second year onwards.

Hybrid vehicles, such as mild hybrids, full hybrids, and plug-in hybrids, will also be affected. In the past, these vehicles paid reduced rates because they produced fewer emissions. From April 2025, hybrids will pay the same standard rate as petrol and diesel cars.

These updates also affect company cars. Benefit-in-kind (BIK) tax, which applies to employees who use company vehicles, may rise for some models. Drivers who use older vehicles may face higher yearly charges depending on their emissions band.

Petrol and Diesel Car Tax (First-Year Car Tax Based on CO2 Emissions)

|

CO2 Emissions (g/km) |

Old Tax Rate (Before April 1, 2025) |

New First-Year Tax Rate (From April 1, 2025) |

Year Two Onward (New Standard Rate) |

|

0g/km |

£0 |

£10 |

£195 |

|

1 – 50 |

£10 |

£110 |

£195 |

|

51 – 75 |

£30 |

£130 |

£195 |

|

76 – 90 |

£135 |

£270 |

£195 |

|

91 – 100 |

£175 |

£350 |

£195 |

|

101 – 110 |

£195 |

£390 |

£195 |

|

111 – 130 |

£220 |

£440 |

£195 |

|

131 – 150 |

£270 |

£540 |

£195 |

|

151 – 170 |

£680 |

£1,360 |

£195 |

|

171 – 190 |

£1,095 |

£2,190 |

£195 |

|

191 – 225 |

£1,650 |

£3,300 |

£195 |

|

226 – 255 |

£2,340 |

£4,680 |

£195 |

|

255+ |

£2,475 |

£5,490 |

£195 |

Electric Car Tax Changes 2025

The biggest update for 2025 is the removal of the VED exemption for electric cars. Before, EV owners didn’t pay yearly car tax because their vehicles produce zero emissions. From April 2025, this has changed.

Electric vehicles will move into the standard VED rate, just like petrol and diesel cars. They will also be subject to first-year rates, although these may still be lower than high-emission petrol or diesel models.

If your EV costs more than £40,000, it will also fall under the “expensive car supplement.” This rule adds an extra charge each year for five years after your car is first registered. Until now, electric vehicles have been exempt from this fee.

Electric Vehicle (EV) Tax (Before and From April 2025)

|

Electric Vehicle Registration Date |

Tax Rate |

|

1 April 2017 – 31 March 2025 |

£195/year |

|

From 1 April 2025 |

£10 in the first year, then £195/year |

While electric vehicles (EVs) registered between 2017 and 2024 will start to pay the £195/year, EVs registered before 2017 will only pay £20/year.

Expensive Car Supplement (ECS) Tax Rate

For vehicles that had a list price over £40,000 when new, both the standard yearly road tax (VED) and the ‘expensive car supplement’ increased starting April 1, 2025. This means owners of higher-priced vehicles now pay more each year.

Below is the tax rates summary:

|

Rate Type |

Old Tax Rate (Before April 2025) |

New Tax Rate (From April 2025 |

|

Standard Annual VED |

£190 |

£195 |

|

Expensive Car Supplement |

£410 |

£425 |

|

Total Annual Tax |

£600 |

£620 |

How to Tax Your Car

Taxing your car is simple and can be done in a few minutes. The easiest way is online using the official GOV.UK website. To tax your vehicle, you’ll need one of the following:

- Your V5C logbook

- Your V11 reminder letter

- The green “new keeper” slip if you just bought the car

When you visit the website, you enter your details, select your payment method, and confirm your tax. You can choose to pay yearly, every six months, or monthly by direct debit.

If you prefer not to use the internet, you can tax your vehicle by phone or at certain Post Office branches. When visiting the Post Office, you may be asked to bring your MOT certificate and insurance details.

If you buy or sell a car, the car tax does not transfer to the new owner. The new owner must tax the vehicle immediately before driving it. The seller will automatically receive a refund for any unused months.

How to Check If Your Car Is Taxed

Before driving, you must make sure your vehicle is properly taxed. You can easily check your tax status using the Smart Car Check tax check tool. By entering your registration number, you can see:

- Whether your car is taxed

- The date your tax expires

- Your MOT status

- The vehicle’s make, model, and colour

This is useful when checking your own car, but also valuable when buying a used vehicle. If a car is untaxed, it means you must tax it before driving it home, unless you are having it transported.

If you’re using the GOV.UK site, the system may show delays or errors. This can happen if your logbook details are incorrect or if the DVLA hasn’t yet updated the recent changes. Your V5C logbook must always show your correct name and address to avoid issues with tax reminders.

When Do You Have to Pay Your Car Tax?

You will need to pay car tax when

- You buy a vehicle

- Your current tax period expires

- You declare the car back on the road after a SORN

Most drivers receive a V11 reminder in the post, but you should not rely only on this. It is your responsibility to know your due date. If you don’t receive a letter, you still must pay. Direct debits make it easier because the payment is taken automatically, but you must ensure your bank details are correct. You can renew your tax up to one month before it expires without losing any time.

If you buy a car, you must tax it immediately, even before driving away. If a vehicle is declared SORN (off the road), you don’t have to pay tax, but you must not drive or park the car on public roads.

READ ALSO: How to UnSORN a Car in the UK

What Happens If I Don’t Tax My Car?

Driving without a car tax can lead to serious penalties. Automatic number plate recognition (ANPR) cameras are used across the UK to check for untaxed vehicles every day. If your car is found to be untaxed, you may receive:

- A fine of up to £1,000

- A penalty letter from the DVLA

- Wheel-clamping outside your home or workplace

- Your car being towed or destroyed

- Court action for unpaid penalties

If you drive a car that is SORN, the fines are even higher because the vehicle is not legally allowed on the road at all.

Untaxed vehicles are also a red flag for insurance companies. Some insurers may refuse claims if your car is involved in an accident while untaxed. Even if they accept the claim, you may face higher premiums in the future.

Changes in Car Tax on All Vehicles

The UK car tax changes 2025 will see electric vehicles not being exempt, and the tax system will be more equal between petrol, diesel, and hybrid cars. Regardless of whether you are driving a new or an old car, it is essential to keep up with the times to be able to budget and not incur unexpected expenses.

It is also more important than ever to check your tax status. Ensure that you have the right details in your logbook, remember to check your renewal dates, and tax your car when you are in time to ensure that you are safe and legal on the road.

Frequently Asked Questions About Car Tax Changes 2025

What are the car tax changes for 2025?

The VED changes, also known as Rachel Reeves car tax changes, come into effect on 1 April and remove the exemptions for electric cars. EVs have become taxable; the first-year rate on new petrol and diesel cars is doubled, the standard rate is raised to £195, and the expensive car supplement of 40,000 is extended to include EVs.

What is the road tax for cars registered between 1 March 2001 and 31 March 2017?

These cars remain on the old CO2-based tax bands. Your annual payment is based on emissions and varies between low emissions rates for cleaner cars and high emissions rates for models that produce over 255g/km. The tax rates range from £20 to £760. These vehicles are not affected by the new 2025 flat rate changes.

Do I need to do anything for the car tax changes?

You don’t need to do anything new for the 2025 UK car tax changes. The way you pay tax stays the same. Only the amount you pay has changed, especially for electric cars and newly bought vehicles.